income tax rates 2022 australia

Tax on this income. Important information July 2022 updates.

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

To get a copy of the form you can either.

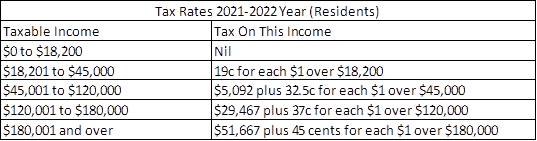

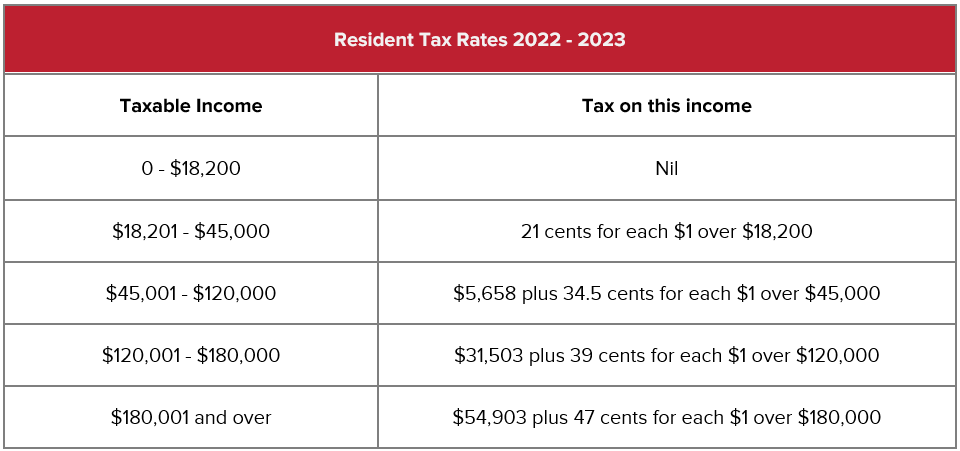

. The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for. Resident tax rates 202223. Tax tables for previous years are also available at Tax rates and codes.

This is expected to take effect from 1 July 2022. 39000 37c for each 1 over 120000. Individual income tax for prior yearsThe.

The Federal Treasurer the Hon Dr Jim Chalmers MP delivered the second Federal Budget of 2022 on 25 October 2022. The measures announced as part of the 202223 Budget are subject to receiving royal assent and. Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2022 according to Trading Economics global macro models and analysts expectations.

5092 plus 325c for each 1. This is calculated from 52 weeks at 81244 per week being 2138 per hour for a 38. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1.

In the 2022-23 Budget no changes have been made to Stage 3 tax cuts and no extension of the low and middle. On 25 October 2022 the Budget for 202223. How to get a copy of the form.

The Minimum wagefor a Full time worker from 1 July 2022 will be 4224688 per year. Place an order to. You can find our most popular tax rates and codes listed here or refine your search options below.

To get an idea of what kind of total tax savings taxpayers on a range of different incomes could make in 202223 compared to 201819 the Australian Government has. Download the Tax return for individuals 2022 NAT 2541 PDF 709KB This link will download a file. The Albanese Government did not make any changes to.

Here is a snapshot of the key tax outcomes of the Australian federal budget 2022. From 1 July 2022Check the fuel tax credit rates from 1 July 2022. Further under the Governments initiative the LITO will be recovered at a lower rate of 5 cents per dollar for taxable incomes between.

Two further incentive regimes are proposed. 19c for each 1 over 18200. Company taxThe company tax rates in Australia from 200102 to 202122.

For the current and 2024 financial years the current. There are seven federal income tax rates in 2022. Income thresholds Rate Tax payable on this income.

Taxable Income Tax Rate. Australia Personal Income Tax Tables for 2022. Make sure you click the apply filter or search button after entering your.

Personal income tax rates Tax rates. There are no changes to most withholding schedules and tax tables for the. The top marginal income tax rate of 37 percent will.

Australian Federal Budget October 2022-23. 2022 Income Tax Rates Australia. Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2.

Tax rates and codes. Base rate entity company tax rates.

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Tax 2022 All The Dates You Need To Know To Avoid 1 110 Fine

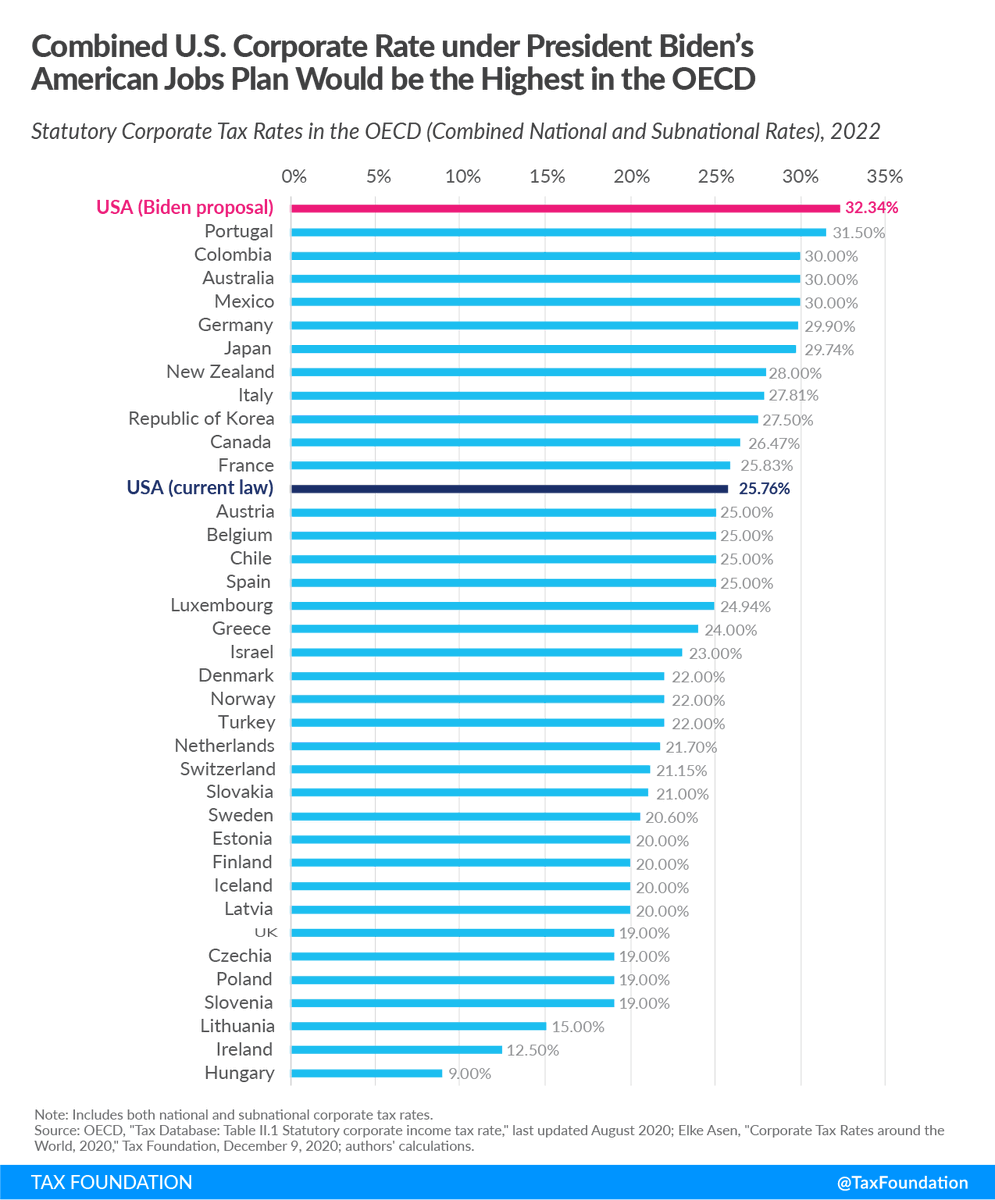

Tax Foundation On Twitter Raising Corporate Income Taxes Would Put The U S At A Competitive Disadvantage Whether One Looks At Statutory Tax Rates Or Effective Corporate Tax Rates Https T Co N82cs9xtbo Https T Co Jdxd1nbdxm Twitter

Everything You Need To Know About Tax In Australia Down Under Centre

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Highest Income Tax In The World Youtube

List Of Countries By Tax Rates Wikipedia

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

The New Personal Tax Cuts Hip Pocket Impact To Individuals Taxbanter

Federal Budget 2021 Will You Get A Tax Cut Ultimate Guide To A Bumper Tax Return

The Latest In Payroll News Australia 2022 2023 Polyglot Group

2019 2020 Federal Budget Tax Brief Mazars Australia

Corporate Tax In The United States Wikipedia

Ato Tax Time 2022 Resources Now Available Taxbanter

%20(1).jpg)

Australia Crypto Tax Rates 2022 Breakdown By Income Level Coinledger

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More